Top Takeaways From the ACC’s Latest Private Credit Market Survey

The ninth edition of the Alternative Credit Council’s (ACC) Financing the Economy research series was recently published. The annual report aims to provide market participants with insights on the trends shaping private credit markets today. To construct the report, the ACC surveyed and conducted one-on-one interviews with 56 managers and investors representing roughly 60% of the total private credit market. Here are our key takeaways:

Increased use of Payment in Kind instruments (PIK): Private lenders operating in the upper middle market direct lending space increasingly offer PIK financing options to borrowers. This feature reduces a borrower’s current cash pay requirements by allowing a portion of regular interest payments to accrue and be repaid at the maturity of the loan. It is a tool helping firms adjust to today’s higher interest rate environment. While private lenders emphasize that PIKs are only offered to borrowers with sound business prospects and fully engaged private equity sponsors, their widespread use highlights that many companies continue to face financing hurdles over the near term.

Larger GPs Expand Market Share: The report notes that 58% of total capital invested by private credit firms comes from a handful of large participants deploying at least $10 billion annually. The big are getting bigger and pushing the average total deal size higher to accommodate supply/demand considerations. This trend is partially why we’ve chosen to focus our efforts on lower middle market opportunities, finding more value investing in a less efficient ecosystem. A private credit executive quoted in the report sums it up well, “There is no doubt that the upper-middle market [private] direct lending space is merging with the [public] leveraged loans market. I think that over time you will see an equilibrium between the [public] high yield bond market, leveraged loan market and direct lending. Borrowers will choose one or the other or a combination of the three.”

Manageable Leverage: Nearly 70% of private credit funds employ one turn (debt to equity) or less of leverage which is conservative compared to other yield-oriented options such as CLO equity or mortgage REITs. However, today, two key market forces encourage managers to keep leverage low: 1) higher base rates, which reduce the need for leverage to achieve target returns and 2) more expensive fund financing options. We expect both will remain in place for the foreseeable future.

More Fund Liquidity Options: We were early adopters of utilizing semi-liquid vehicles for private credit investments. In our view, the structure provides an attractive way to deploy and gain exposure to high cash-flowing, short-duration private credit assets. Various features like lock-up periods, investor-level gates and slow pay provisions help manage liquidity risk and the viability of the fund. The ACC’s report highlights the increased use of open-ended structures by LPs for private credit investments, which helps expand our funnel for potential investments.

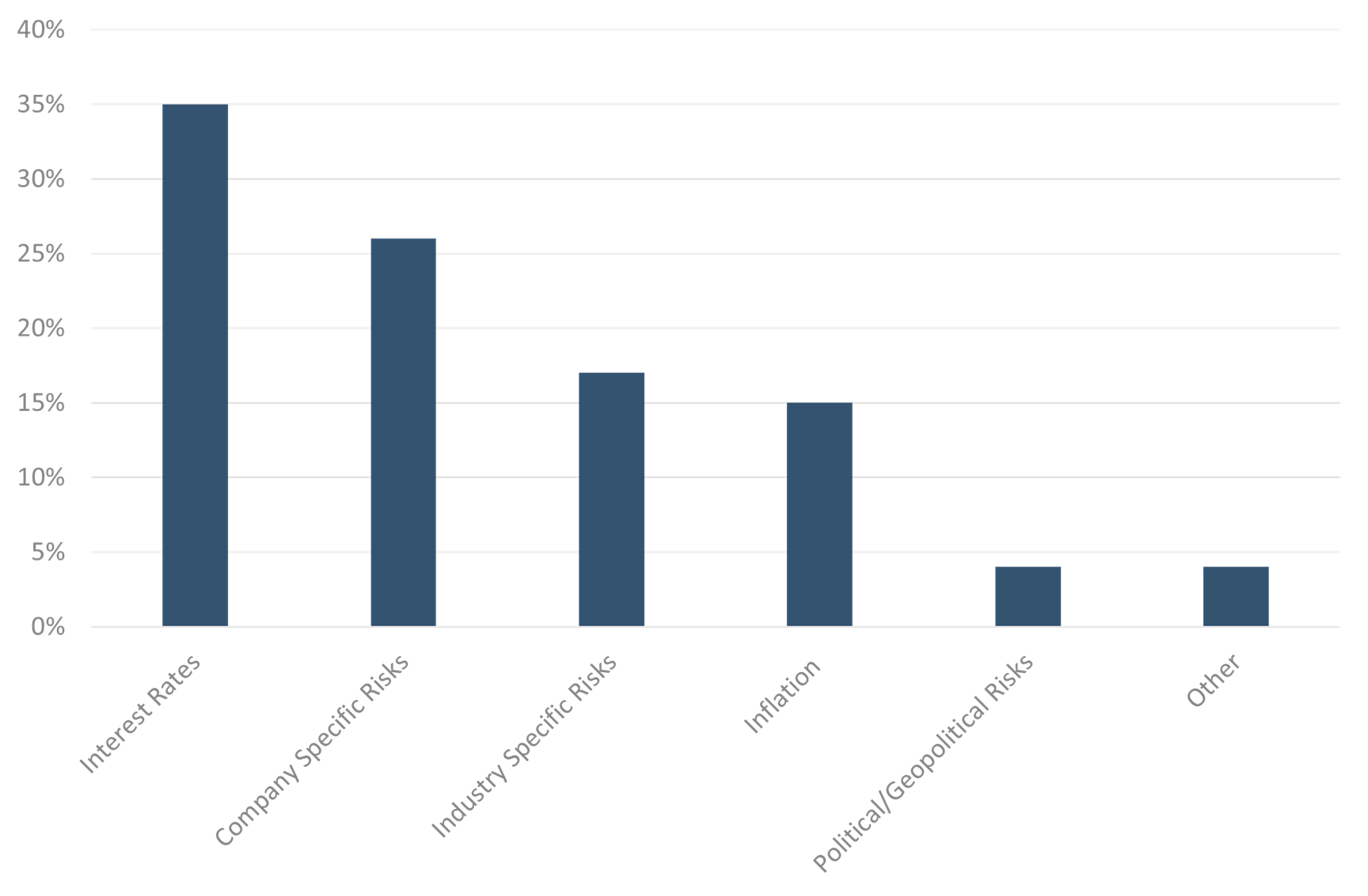

Fig. 1: What is the biggest challenge affecting borrowers in your portfolio?

Download Document

Download NowDisclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.